Imagine that you need to sell a pack of shares. In the legacy world it is a process which entails paperwork, communication with different firms such as stockbrokers, lawyers and various people and involves a number of risks. That’s why the absolute majority of investors decide to find an agent, broker, exchange or generally a service provider, who deals with all the formalities and acts as an intermediary, overseeing the deal until it’s closed.

EDSX – European Digital Assets Exchange

Category: Uncategorized

I SEGNI DEL SUCCESSO

Mauro Andriotto tiene una discussione con Sergio Luciano di “SOS investire”. Mauro confronta diverse fonti di finanziamento, tra cui fondi di venture capital, piattaforme di crowdfunding, borsa e un nuovo strumento: la blockchain e i titoli digitali. Il progetto Bitminer, del Gruppo Angeli di Firenze, è un esempio di strutturazione di un’offerta di azioni digitali.

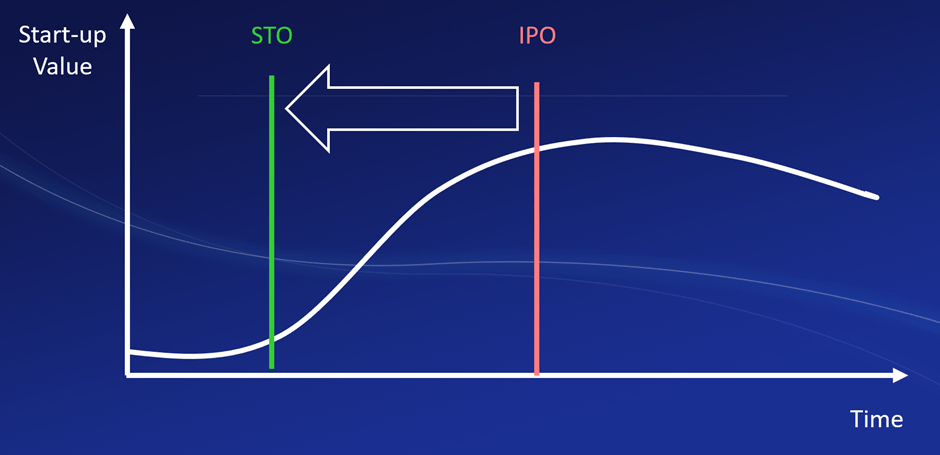

STOs and Business Life Cycle

The business life cycle is the progression of a business in phases over time and is most commonly divided into five stages: launch, growth, shake-out, maturity, and decline.

Switzerland and STOs: strict but explicit and open-minded

Switzerland, which is known for their superb banking system and strict regulations, was one of the first in the world that started explicitly to exercise control on ICO/STO issuance and crypto fundraising.

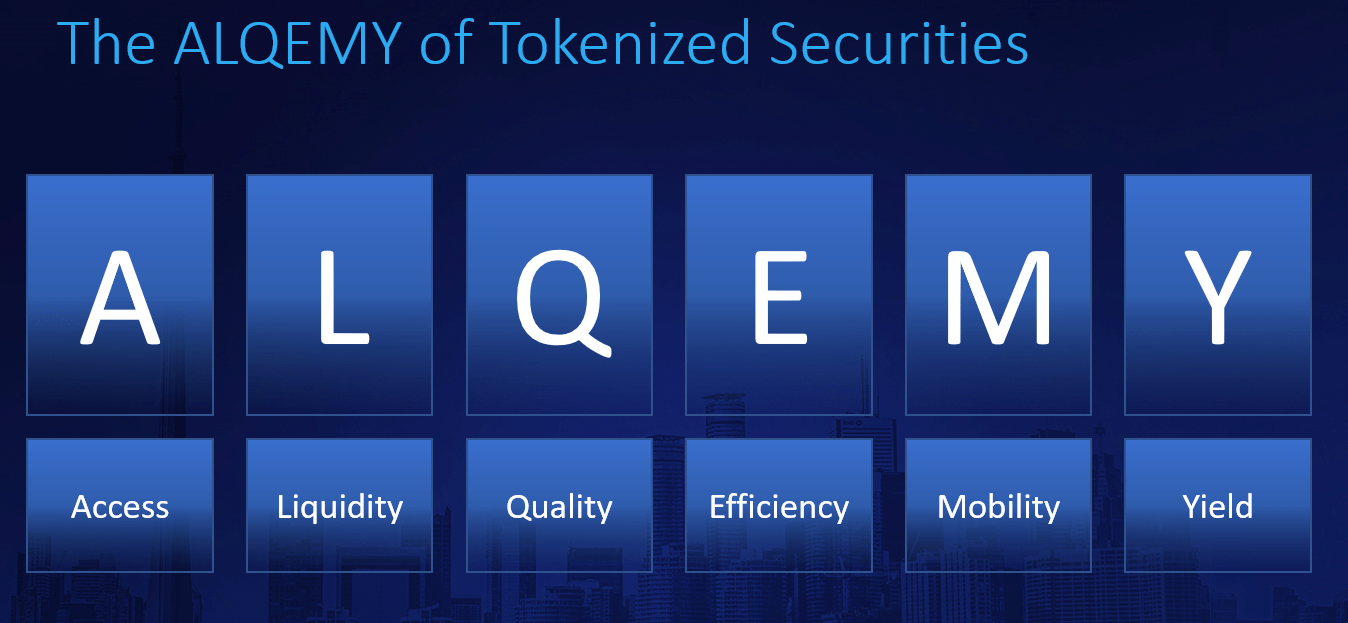

The ALQEMY of Tokenization

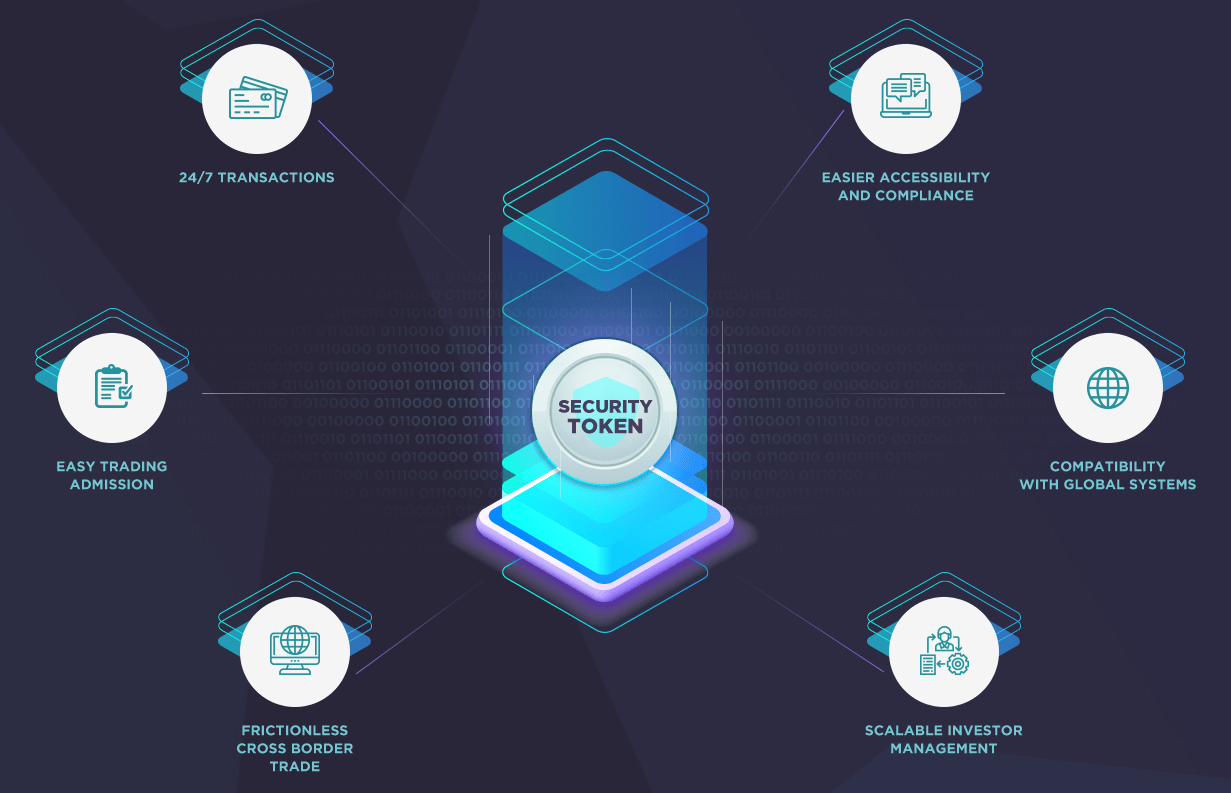

The tokenization of assets and resources enables quicker, cost-effective, and increasing in functionality configurations.

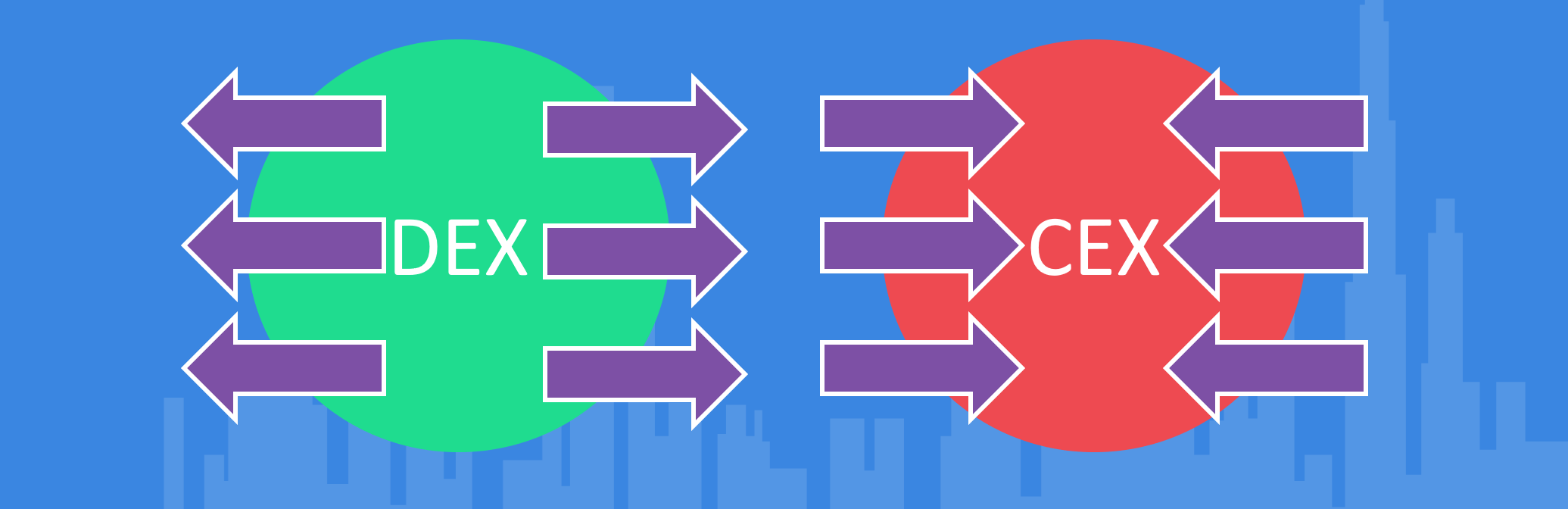

Issues with Exchanges and the EDSX Solution

Cryptocurrency, tokens and coins are traded on two types of exchanges — centralised (CEX) and decentralised (DEX). There has been a lot of speculation on whether centralisation, as a phenomenon, is relevant in the realm of crypto.

Tokenization of Securities and its Consequences

Unlike IPOs which require an arduous and expensive process with many middlemen and brokers, STOs are easy to pull off.

Key Distinctions between IPOs and STOs

IPO and STO are identical in their objective and effect. Both aim to raise capital in return for a security. The security can be an equity, preferred stock, bond or any other instrument that gives rights on income and claims on the assets of the issuer in the form of debt or liquidation equity.

Security Token Offering vs. Crowdfunding

Security tokens represent investments or an investment contract into an underlying investment asset, such as stocks, bonds, funds and unit trusts.

First Blockchain IPO with Swiss company OverFuture

The Swiss Commercial Register has given the green light for the first incorporation of a company for an initial public offering (IPO) of tokenized shares on a blockchain.