IPO and STO are identical in their objective and effect, yet there are key distinctions between them.

Both aim to raise capital in return for a security. The security can be an equity, preferred stock, bond or any other instrument that gives rights on income and claims on the assets of the issuer in the form of debt or liquidation equity.

If security token offerings are also public offerings under regulations, then what is the real difference? Can there be advantages for carrying out an STO rather than an IPO?

In terms of parties involved, structuring, technology and therefore costs IPO and STO differ tremendously. IPOs involve a lot of intermediaries, agents performing either core or auxiliary roles. All these roles need remuneration and demand a piece of the proceeds. What is more important though is that the core service providers in an IPO act as gate-keepers to an elite club and their subjective judgement can make or break a business offering. That is why IPOs do not suit small and medium sized companies but only serve as an exit option when companies have achieved scale and size and winners in the race have determined themselves.

The IPO is a centuries old practice with a lot of baggage and redundant elements which bear no touch to modern reality.

This baggage is heavy and the time has come for its evolution. STOs bring IPOs to the 21st century with a number of benefits for both investors and business owners. As a result many influential players agree that STOs will disrupt the IPO markets and even replace them completely.

Both methods of public fundraising are based on financial instruments. In an IPO, the investor buys stocks representing equity in a company, becoming an owner of a percentage. Stocks provide dividends and liquidation equity rights. In a STO, the investor buys a token also representing equity, gaining rights to dividends, liquidation equity, and voting. STOs can tokenize any asset or business, with variations like bonds providing interest and principal repayment over time.

So what is the difference?

Essentially STO’s eliminate intermediaries, save costs and lower the size threshold to include SME and start-ups.

STO benefits over IPO

- Costs— Experts estimate that an STO campaign costs 40% less than an IPO, mostly because it occurs in digital form on a decentralized blockchain network. Smart Contracts facilitates regulatory compliance allowing more effective sales and exits by eliminating intermediary fees. All actions associated with a token are programmed into it making possible a range of automatic activities and steps.

- Lower barrier of entry — Just like IPOs, STOs are legally bound, and therefore the collaborations of lawyers and advisors are also necessary. This costs money. Nevertheless, the charges are much less than paying the investment banks along with brokers. Plus, STOs supply much more direct and transparent way to access a broader investor base, minimizing brokerage fees as compared to conventional investment banks.

- Global — Businesses usually perform IPOs within the jurisdictions where they operate, shutting out foreign investors. STOs can resolve this issue by investors agreeing to be treated as local persons or entities under the jurisdiction issuing the token. For EDSX, an EU individual must acknowledge and consent to treating themselves as a local Swiss resident since EDSX operates from Switzerland. Investors also need to have an account (essentially undergone KYC) on the STO platform to take part in it. Therefore, STOs are not limited to a specific area (unless if that is the intention). This trait alone brings incredible advantage in boosting the investor pool.

- Novel — Cryptocurrencies and also ICOs swept the financial markets as no one ever anticipated, except for the hardcore followers and crypto believers. This sentence does not contain any passive voice, so no changes are needed. Unfortunately, the majority of people involved in ICOs lost their money due to its unregulated nature. This investor group is now interested in safer and better investments. The investor profile can be somewhat different between an STO investor and an ICO investor, though the curiosity in STOs is already significant, and provides excellent reception amongst these brand new investors. Particularly the younger generations are happily adopting token investments rather than opening classic investment accounts with brokers. These individuals do not operate on traditional stock markets and probably never will. Institutional investors that invest in the traditional stock markets although going to continue to do so will also start purchasing and holding security tokens in their portfolios.

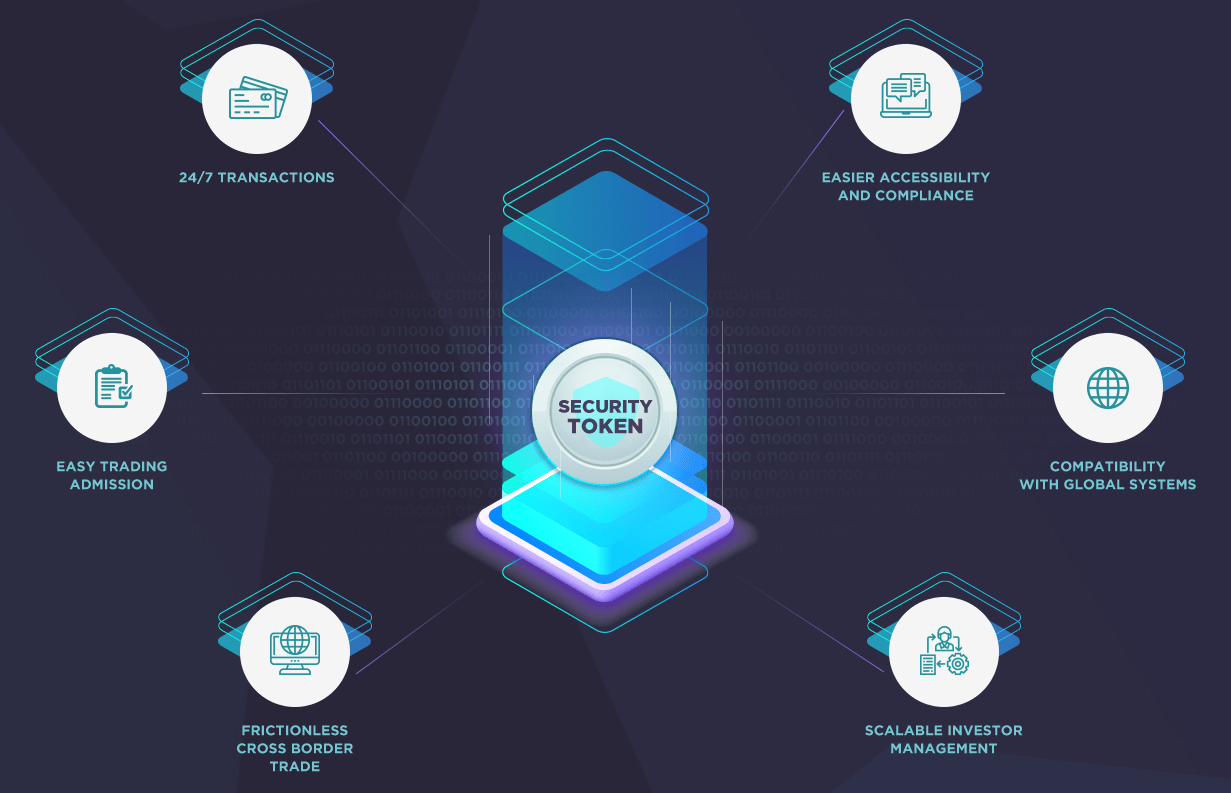

- Continuous access – 24/7/365 — Trading in the security token market is 24/7/365 with 99.99 % uptime. Because Security Tokens and STOs decentralize and automate processes, the underlying code incorporates many administrative responsibilities normally performed by executives, stakeholders, panel members, financial analysts, and brokers in analogous human-run public businesses. Issuance, reporting, settlement, clearance, underwriting, exchange, registry, and compliance do not involve human intervention in a security token. Hence the convenience to acquire or dispose of them around the clock.

STOs will disrupt traditional IPOs

Traditional IPOs feature a track record of high exclusivity, only available to a tiny, pre-selected group of investors. With STOs the objective is different. An inclusive offering better serves the need for going public, while providing substantial financial savings. The reduced costs are not the sole advantages of STOs. Since STOs are available to a much broader audience beyond the exclusive big-player club, they provide greater investor access, better returns and prices, and deeper liquidity.

The macro and micro Tokenomics is still in its nascence. STOs exemplify the next logical step after the ICO frenzy, and experts expect them to continue evolving. Many considered 2020 the year of the STO until the COVID outbreak. After resolving the pandemic crisis, innovators may transform the game. A new innovation could surprise us, something we didn’t imagine before. Working in this field is thrilling. The industry is new, unpredictable and always changing. It leaves financiers on the edge of their seats. All are waiting to see what will happen next.

Based in Zug, the platform is fully compliant with all Swiss laws related to financial intermediaries, banking, anti-money laundering, and organized trading facilities. Among its core values, there are innovative solutions through blockchain technology, which ensures security and liquidity.

EDSX is the first platform in Europe with primary and secondary markets for both institutional and retails. EDSX is a pioneering platform that employs the world’s leading technology to globally list security tokens in both primary and secondary markets, listing digital securities of real financial instruments to the public with a decentralized peer-to-peer exchange. Our goal is to fully engage every aspect of the financial revolution.

Do you have a question for us?

Send your query here:

[email protected]