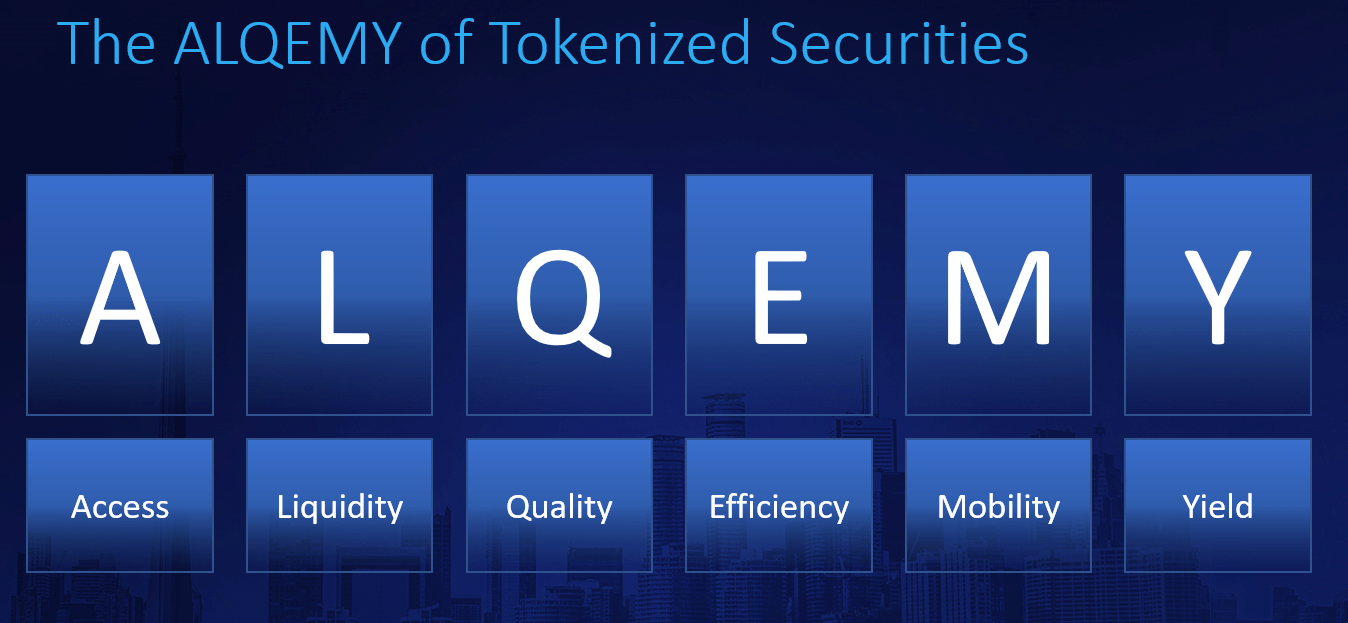

Our team member Dr. Zlatin Sarastov coined the ALQEMY of tokenization at a conference in Jakarta in 2019. It reflects all of the enhancements brought by tokenization on DLT of general financial instruments.

(A) Stands for Access, as both investors and issuers enjoy tremendously improved access to each other

(L) respectively for Liquidity, as securities are tradable before a final exit or IPO

(Q) means Quality as all such tokenized instruments, being securities are compliant to securities regulations for investor protection

(E) denotes Efficiency as all intermediaries of a normal IPO process are eliminated, especially custodians and legacy exchanges

(M) means Mobility as the digitized instruments are accessible 24/7/365

(Y) stands for yield as all of the above features bring improved risk/return profile of an instrument

The tokenization of assets and resources enables quicker, cost-effective, and increasing in functionality configurations. High liquidity from tokenized securities gives an alternative to conventional bond, stock and income investment. New rules ensure customer safety, creating innovative secure asset exchanges.

The introduction of tokenized securities dates from several years back with the adoption of blockchain and DLT in general. The concept began two years ago as crypto markets evolved. Many ICOs proved to be scams, with over half operating unethically, fueling securities demand.

The main reasons for asset tokenization is the enhanced liquidity. The tokenized securities` liquidity allows for tremendous enhancement of value of a whole set of securities. It makes also explicit the price of the tokenized shares or stocks. It is a time-saving and easy-to-complete process in terms of purchasing, selling, and exchanging. Prior to the launch of the blockchain technology, the level of assets liquidity was relatively low, because of the sluggishness of conventional asset trading and waiting times for transaction verifications. Stocks and bonds are often purchased through intermediaries like brokers and banks, further delaying the full completion of a transaction.

Despite the fact that tokenized securities offer an additional layer of security compared to standard tokens, a real challenge for the market remains the regulation of tokenized assets. Governing bodies across the globe are striving to introduce standardization methods for control and clear and cohesive frameworks. The law compliance remains an issue, although there is a clear indication that with the evolvement of the market, the regulations and standardization methods will continue to grow in number.

The Canton of Ticino, Lugano is a pioneer in that respect as its commercial register approved finely-worded application as well as articles of association filed by Prof. Mauro Andriotto on behalf of a client to have its common shares issued on the Ethereum blockchain and the shareholder book kept on the blockchain as well. This is the first ever worldwide inscription of tokenized securities into an official register. From this moment onwards the general rules for shares and bond as per Swiss law apply with the added benefits of access and liquidity.

Tokenized securities are made publicly available via a Security Token Offering (STO). EDSX`s tokenized securities are currently available to the mass public at EDSX offering real shares of existing businesses to the global market.

Based in Zug, the platform is fully compliant with all Swiss laws related to financial intermediaries, banking, anti-money laundering, and organized trading facilities. Among its core values, there are innovative solutions through blockchain technology, which ensures security and liquidity.

EDSX is the first platform in Europe with primary and secondary markets for both institutional and retails. EDSX is a pioneering platform that employs the world’s leading technology to globally list security tokens in both primary and secondary markets, listing digital securities of real financial instruments to the public with a decentralized peer-to-peer exchange. Our goal is to fully engage every aspect of the financial revolution.

Do you have a question for us?

Send your query here:

[email protected]